0

0

items

No products in the cart.

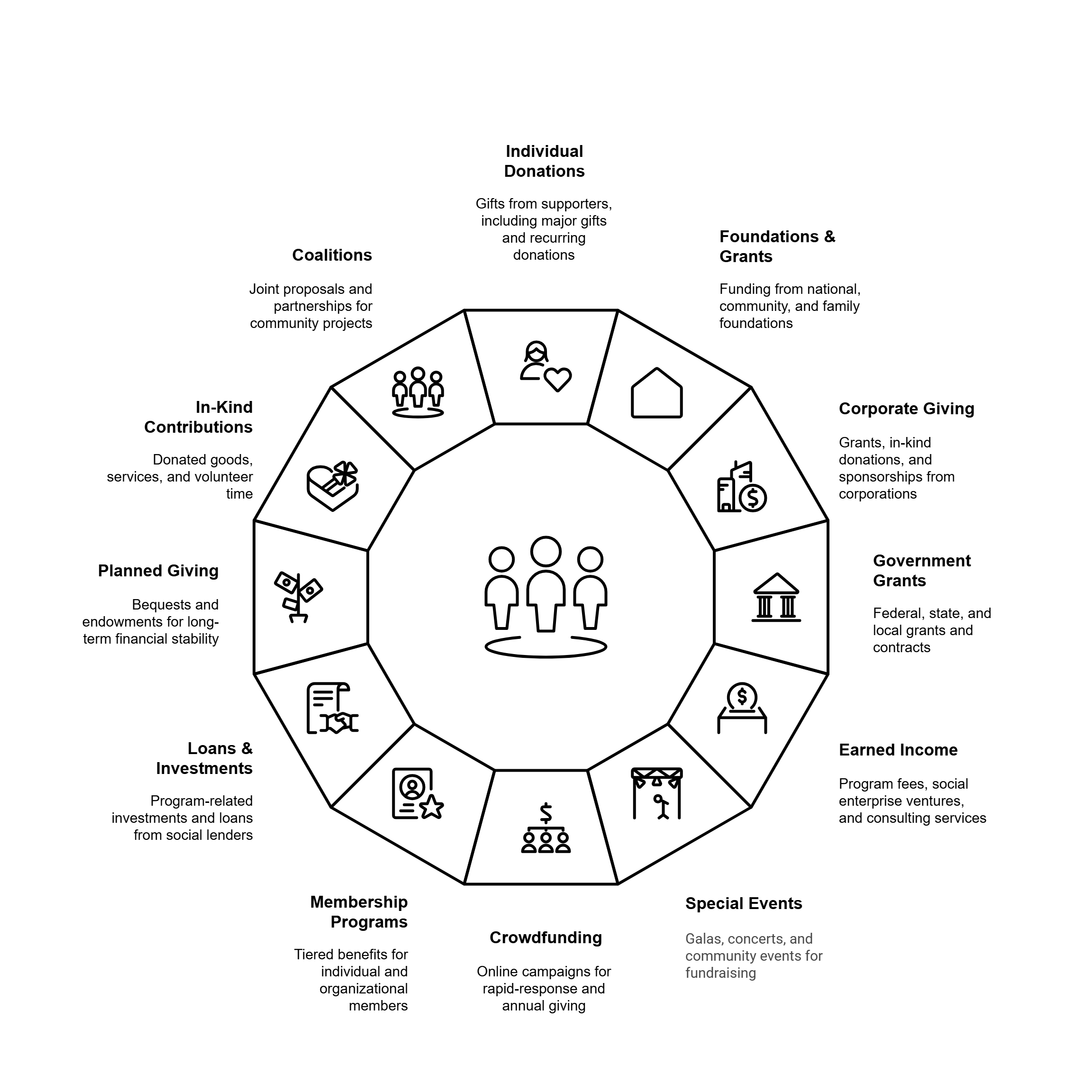

Nonprofits often hear the advice, “Don’t put all your eggs in one basket,” when it comes to funding. Consider a small community arts nonprofit that heavily relied on a single annual gala. When the gala had to be canceled one year, the organization faced a funding crisis. Revenue diversity is about building a mix of funding sources (e.g., grants, donations, earned income, etc.) so that the loss of any one source isn’t devastating. In practice, adding new funding streams can boost financial stability, up to a point. Research shows that nonprofits with two major revenue sources tend to be more financially healthy than those with only one. A second revenue line (e.g., supplementing government contracts with fundraising) often helps cover costs that a single source alone cannot. However, more isn’t always better; chasing too many different funding streams can actually hurt profitability by adding complexity and overhead. In other words, some diversification is good, but over-diversifying may spread an organization too thin.

This insight may seem to contradict conventional wisdom. Notably, a Stanford Social Innovation Review study found that over 90% of large, high-growth nonprofits actually concentrated on a primary funding source rather than pursuing a bit of everything. Those organizations achieved scale by focusing on one dominant revenue category (e.g., government grants or corporate sponsorships) that matched their mission, and building strong infrastructure around it. For many small nonprofits, though, relying on a single source isn’t viable, and you might not have a “golden goose” funder writing huge checks. The key is finding a healthy balance, meaning diversify enough to avoid total dependence on one source, but be strategic. Choose funding streams that align with your organization’s strengths and mission, and develop the capacity (i.e., skills, systems, relationships) to manage each effectively. If a particular grant or donor base provides the bulk of your support, make sure you also cultivate one or two secondary sources as a cushion.

Ultimately, revenue diversity is about resilience. A more varied funding portfolio can help your nonprofit weather storms. For example, if government funding gets cut, individual donors or earned income can keep you afloat. It also empowers you to say no to funding that might pull you off mission, because you have other options. But remember that every revenue stream comes with effort attached. It’s better to have a few well-managed funding sources than to scramble after every possible dollar and burn out your team. By thoughtfully broadening your funding base, you can reduce financial risk while staying focused on what you do best.

Transforming your nonprofit’s operations is more than just improving processes—it’s about creating a seamless, sustainable foundation for growth. With every streamlined workflow and optimized resource, you unlock new potential to drive your mission forward. Build a culture of clarity, efficiency, and purpose, ensuring your team has the tools to thrive at every stage.

About the Author

Trina Ntamere is a passionate entrepreneur and dedicated mother to an amazing daughter. She holds an MBA from the Darden School of Business and has over 15 years of experience helping nonprofits streamline their program operations and improve resource allocation. As the founder of Lavender Eucalyptus, LLC, Trina specializes in creating efficient workflows and sustainable strategies that empower nonprofits to achieve mission-aligned impact and operational excellence.

Contact us today to discover how we can partner to drive your nonprofit’s success.

Let's TalkExplore our comprehensive suite of services designed to bring calm and clarity to your financial management processes. Discover how Lavender Eucalyptus can help you achieve operational excellence and amplify your impact.

ExploreSubscribe now to keep reading and get access to the full archive.

You must be logged in to post a comment.